Source: Baiwei Storage

Benefiting from the rapid development of the storage industry in recent years, the revenue scale of Baiwei‘s embedded storage has been growing, from 579682300 yuan in 2019 to 1676304900 yuan in 2021, with a compound annual growth rate of 70.05%.

Wang Can pointed out: "The company has always attached great importance to the embedded storage business. The reason for this is mainly from our judgment on the entire storage field: in the future, the data in the entire storage field should be concentrated in two directions, one is the cloud, that is, the enterprise and the data center; the other is the endpoint device."

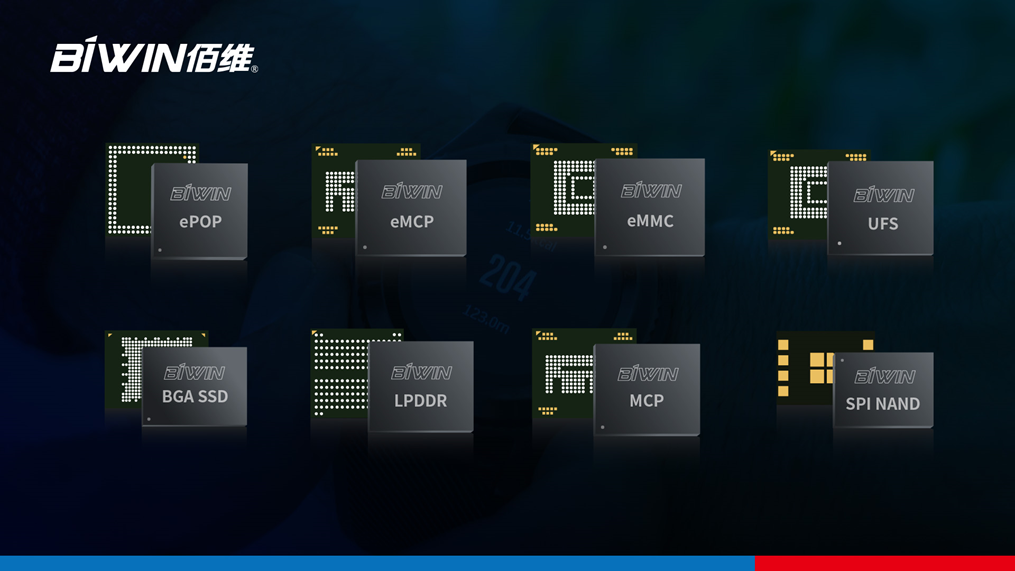

On the endpoint device side, with the continuous improvement of demands for power consumption, performance, reliability, etc., embedded storage will have a considerable development in this field in the future. Based on such an overall judgment, Baiwei has a relatively in-depth technology and product layout in the entire embedded memory chip field, such as ePOP, eMCP, eMMC, UFS, in combination with the company‘s own media application and algorithm research and development capabilities and sealing test capabilities.

"For example, in the field of intelligent wear, more attention is paid to the level of power consumption, so we can provide some matching low capacity and low power storage products." For example, Wang Can said, "For mobile phones, the requirements will be higher. We have good sales in overseas regions of the common 8GB LPDDR operating memory. In addition, in some mainstream memory markets, we have basically completed full coverage."

With years of industry development, Baiwei‘s embedded memory has entered the supply chain system of many leading customers in the industry, including ZTE, Skyworth, Zhaochi, Chaoge, Google, Facebook, Bubugao, Median Holding, TCL, iFLYTEK, Foxconn, Huaqin Technology, Wentai Technology, Tianlong Mobile, Longqi Technology, Zhongnuo Communication, etc.

"At present, our embedded storage is in a relatively leading position in China. In addition to traditional ePOP, eMCP and eMMC, BGA SSD is also a large category of embedded storage. It can be used in laptops, game phones and other smart terminals with high requirements for performance and energy efficiency, which is an important direction for the company‘s future development." Wang Can stressed.

To B+To C double strategic development, driving the global layout of the brand

In addition to embedded storage, Baiwei Storage has also made good progress in consumer storage and industrial business.

According to Wang Can, Baiwei consumer storage includes solid state disk, memory module, mobile memory and other products, featuring high performance and high quality. Among them, the company‘s SSD products have a transmission rate of up to 7400MB/s, leading the industry, and support data error correction, life monitoring, abnormal power loss protection, data encryption, end-to-end data protection, power consumption monitoring and control and other functions; In terms of memory modules, the company has officially released DDR5 memory modules, with a transmission rate of 6000Mbps and 7000Mbps in the future, which can meet the demands of customers in the PC and server fields for extreme performance.

It is worth mentioning that, in view of the needs of different end consumer markets of To B and To C, Baiwei has launched different brand products and matching sales strategies.

In the B-end field, for the PC front-end market such as domestic PC brands and PC OEMs, the products provided by the company‘s Biwin brand mainly include high-performance, high-quality consumer grade solid state drives and memory modules. With long-term technology research and development accumulation and intelligent production test system, the company‘s products have passed the rigorous pre installation import test of leading customers in the PC industry, and reached the international first-class standards in terms of performance, reliability, compatibility, etc.

In the B-end field, for the PC front-end market such as domestic PC brands and PC OEMs, the products provided by the company‘s Biwin brand mainly include high-performance, high-quality consumer grade solid state drives and memory modules. With long-term technology research and development accumulation and intelligent production test system, the company‘s products have passed the rigorous pre installation import test of leading customers in the PC industry, and reached the international first-class standards in terms of performance, reliability, compatibility, etc.

Some consumer storage products operated by Baiwei

Source: Baiwei Storage

Wang Can said: "The company‘s To B-end business has developed rapidly, and now has entered the supply chain system of well-known PC manufacturers at home and abroad, such as Lenovo, Acer, Tongfang, Inspur Information, Foxconn, etc. In the domestic non x86 market, the company‘s SSD products and memory modules have successively been adapted to the domestic CPU platforms such as Godsone, Kunpeng, Feiteng, Megacore, Haiguang, Shenwei, and other domestic operating systems such as UOS, Kirin, and have been widely recognized and purchased in batches by complete machine manufacturers. In the future It is expected to remain in a relatively good growth trend. "

In the field of C terminal, the company developed PC aftermarket, e-sports, mobile storage and other ToC markets through its sub brand Biwintech and its operating agent brand, and achieved good market performance.

Among them, Biwintech is a private brand of the company, focusing on the young generation consumer market, providing consumers with full scene storage demand solutions for office, games, outdoor shooting and other scenarios. Its main products include solid state disk (SSD), mobile solid state disk (PSSD), computer memory card and other storage devices.

In terms of authorized agents, since November 2016, the company has successively obtained brand authorized agents from HP, Acer and Predator.

Some products of Predator brand operated by Baiwei

Source: Baiwei Storage

Wang Can pointed out: "Since the operation of these agent brands, the company has fully exploited the sales potential of online platforms such as JD, Amazon, Newegg and offline dealer channels. The sales volume of products has been in the forefront of the industry, and the brand reputation has continued to improve. In the Latin American market, HP Memory products showed strong performance and once occupied the first place in memory imports of Peru and other countries. In the promotion activities of JD 618 Shopping Festival and Double 11 Shopping Festival and other platforms in 2020, HP SSD product sales ranked in the top five; Predator mainly focuses on high-end e-sports market, and we are its only agent in the world. During the 618 shopping and Double 11 shopping festival of JD in 2021, we have also entered the top ten memory stores. "

In terms of industrial storage, Baiwei‘s main products include industrial specification level SSDs, on-board SSDs and industrial memory modules, which are mainly targeted at industrial market segments and applied to 5G base stations, smart cars, smart cities, industrial Internet, high-end medical equipment, smart finance and other fields. Baiwei has developed many technical solutions for industrial applications in different fields to meet the application needs of different scenarios. In order to lay out the application market of vehicle specification level memory products, the company obtained the IATF16949:2016 automobile quality management system certification in 2018.

Main products of Baiwei industrial storage

Source: Baiwei Storage

Wang Can introduced that the company‘s industrial storage is dominated by A, B, G and M series of SSD products, Each series of products includes 2.5 "SSD, mSATA, SATA M.2 SSD, NVMe M.2 SSD in different product forms to meet different needs and scenarios of customers. Among them, Series A products belong to the entry level of normal temperature (operating temperature: 0 ℃~70 ℃); Series B is applicable to the requirements of small file intensive writing and frequent abnormal power down application scenarios; Series G is applicable to wide temperature environment (operating temperature: - 40 ℃~85 ℃) ; The M series can meet the requirements of high temperature and high reliability application scenarios.

Integrated operation mode of R&D and seal testing to build the core competitiveness of storage products

As the largest sub industry in the semiconductor industry except for logic chips, memory accounts for more than 1/4 of the total. According to the data of the World Semiconductor Trade Statistics Organization (WSTS), the global memory market in 2021 will approach 153.8 billion US dollars, with a year-on-year growth of 30.9%, which is only 33.1% lower than that of analog chips.

From the perspective of category segmentation, NAND Flash and DRAM are its largest market segments, accounting for more than 95% of the total storage market. In the field of NAND Flash, Samsung, Western Data, Armour Man, Micron, SK Hynix, Intel and other enterprises accounted for more than 90% of the shares, while the domestic manufacturer Changjiang Storage accounted for only 1%; In the field of DRAM, Samsung, SK Hynix and Micron will have a total market share of more than 95% in 2020. The domestic DRAM wafer manufacturers are mainly Hefei Changxin, which is still in its infancy.

Competition pattern of global storage market in 2020

Source: omnia; Core starling finishing

It is worth noting that at present, the IDM mode is widely adopted by the above large storage plants, and they have penetrated into the downstream memory product field by virtue of their strong wafer manufacturing capabilities, so as to continuously increase their market share.

However, the good news is that at present, the technical specifications of the same generation products of each wafer factory tend to converge in terms of capacity, bandwidth, stability, etc. The functional characteristics of memory must be realized through the back-end links of the industrial chain such as storage medium application technology and chip sealing and testing. Therefore, this gives non IDM manufacturers ample living space and development opportunities.

Based on this, Baiwei Storage has laid out a business model of integration of research, development, sealing and testing of storage medium characteristics, core firmware algorithm development, advanced packaging of storage chips, research and development of storage chip testing equipment and algorithm development, and has the ability to build channels for global brand sales, which enables the company to have important advantages in ensuring product performance, mass supply, customized development, product consistency assurance, etc.

Wang Can said: "Huizhou Baiwei was established at the end of 2016, focusing on memory sealing test and SiP sealing test services. The company is the leader in packaging technology in China, mastering 16 layers Die, 30~40 μ M Ultra thin Die, multi chip heterogeneous integration and other advanced process mass production capacity. At present, the company‘s sealed test products are steadily improving in yield and capacity utilization, mainly providing high-quality storage sealed test services for the parent company and its large and medium-sized important customers. "

The reporter from Bugs Core noticed that the first phase of Huizhou Baiwei Sealing Test Project has been completed and put into production, specializing in sealing test of NAND and DRAM memory chips. The company has strong sealing and testing technology, and is one of the few domestic manufacturers that can mass produce 16 layers of Die memory chips. It is estimated that 75KK chips can be sealed and tested every month after the Huizhou sealed and tested project is completed and put into production.

Baiwei R&D, sealing and testing integrated business model

Source: Baiwei Storage Prospectus

"Through the combination of self built sealing and testing capacity and memory R&D and design, the company can provide customers with differentiated services such as strong customization capability, fast development, short delivery time and excellent quality." Wang Can said, "In the future, the focus of the company‘s entire capital investment will still be on our entire middle and back-end, including the R&D investment in our storage media applications and the sealing test. We will continue to enhance the company‘s entire sealing test capability to ensure the core competitiveness of the company‘s storage products."

It is well known in the industry that due to the impact of weak consumer electronics demand and the high inventory level of manufacturers and clients, the storage supply chain is under great pressure to de inventory. Since the end of last year, the storage price has been in a downward channel.

For this, Wang Can said: "The storage industry is a typical volatile industry, and the rise and fall of the industry price is a very normal phenomenon. In fact, the whole price fluctuation only affects short-term strategies and behaviors such as inventory and terminal stocking, and does not affect the company‘s strategic judgment on the future of the entire storage field. With the continuous growth of data demand, the entire storage field must be developing in a spiral direction in the future. Especially in the Chinese market, relying on the country‘s inventory With the support of the storage industry strategy, the whole industry chain will get a better development opportunity in the future. I believe that Baiwei can also gain a better growth and share in this. "

epilogue

As the largest producer and consumer of electronic equipment, China is the largest terminal user of memory chips, but domestic memory chips currently account for a very small proportion, less than 5%. Therefore, the domestic memory industry has huge growth space, and domestic memory manufacturers will usher in huge development opportunities.

Driven by the innovation strategy, Baiwei Storage continuously expands its general-purpose storage product line to meet the needs of end customers for standardized and large-scale storage; At the same time, the company can provide deeply customized storage solutions and terminal product SiP services for specific industry segments.

With the continuous improvement of downstream application market‘s demands for memory performance, power consumption and other aspects, Baiwei, which has the ability to integrate R&D, design, packaging, testing and manufacturing, and brand operation, is expected to usher in further development in the digital economy era.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you!

中恒科技ChipHomeTek

|