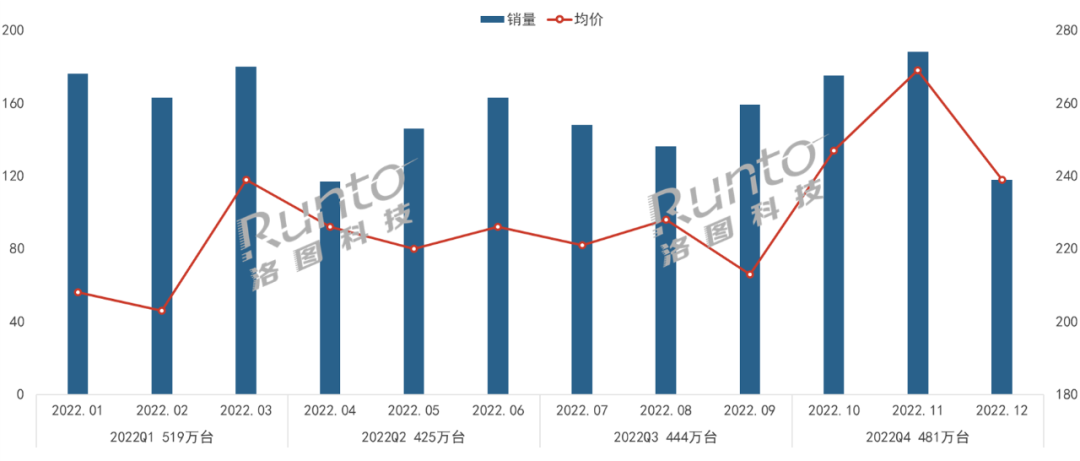

Monthly sales volume and average price of China‘s surveillance camera online market in 2022, unit: 10000 units, yuan

Brand pattern: competitive market; Xiaomi often ranks first

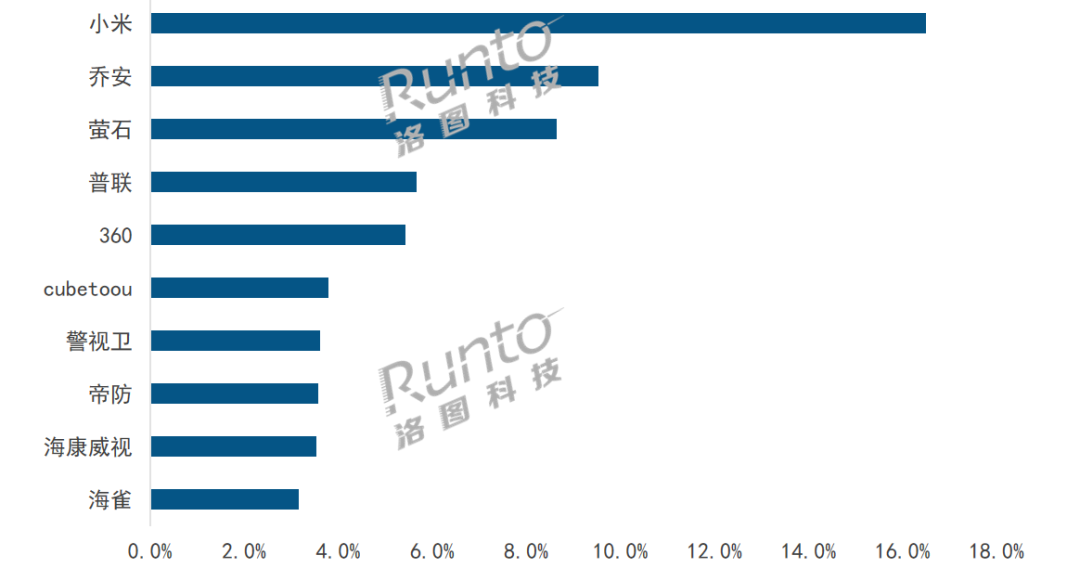

The market competition of cameras is reflected in two aspects. On the one hand, the number of industry participants is large, and the number of online brands will reach 672 in 2022; On the other hand, the brand concentration is low, and no brand accounts for more than 20% of the market. The total share of TOP4 brands (CR4) is 40.4%, which is at the balance line level.

Xiaomi has its own advantages such as high brand awareness, product cost performance and scene ecological ability. It has been ranked first on the line in 2022, and its sales share is far higher than that of other brands, maintaining at more than 16%.

Joan and fluorite are between Bozhong. As a traditional security brand, Qiao An gained a stable share by relying on rich product lines and friendly prices. Fluorspar has Internet characteristics, and also has guarantee in product research and development and technology accumulation. It landed on the Science and Technology Innovation Board at the end of December last year. The share gap between the two brands is relatively small, with Joanne slightly higher than fluorite in the whole year, ranking second; However, fluorite continued to develop in the fourth quarter, and its ranking in a single month was higher than that of Joan.

Pulian and 360 ranked fourth and fifth, respectively, belonging to network and security enterprises, with brand influence, and thus won the recognition of a group of consumers. In 2022, the online market share reached 5.7% and 5.4% respectively.

Hikvision is a giant enterprise in the field of security monitoring. It mainly promotes industrial cameras and complements its sub-brand fluorite in product and marketing. In 2022, the total online share of Hikvision and fluorite will exceed 12%, second only to Xiaomi.

As Huawei‘s eco-chain partner, the product has certain advantages in humanized design and ecological linkage, ranking in the top 10.

In addition, Internet, home appliance and mobile phone manufacturers such as Huawei, Hisense, Lenovo, TCL, OPPO, ZTE, LeTV, Tencent, and Tmall Smart all have their own layout in the surveillance camera market. Among them, Lenovo performed quite well, and began to work hard in the second half of 2022, ranking from 28th in January to 9th in December.

Sales share of top 10 brands in China‘s online surveillance camera market in 2022, unit:%

Product direction: PTZ, 4 megapixel, storage, night vision, intelligent care

Driven by big data, artificial intelligence, 5G, the Internet of Things and other technologies, the surveillance camera is no longer a simple video input device, but shows new features in product form, performance and function.

In terms of product form, the camera changes from fixed form to rotatable form. The PTZ camera has become the mainstream of the home camera market, with its share increasing from 55% in January to 72% in December.

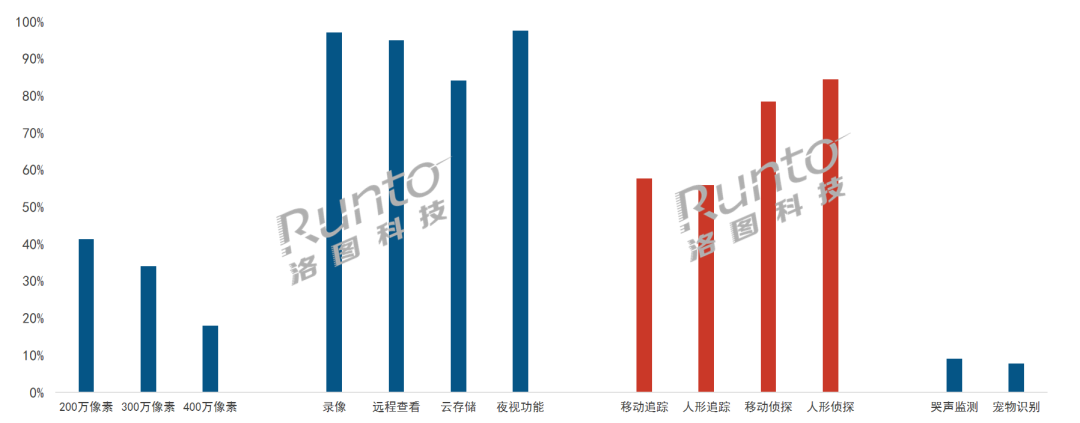

In terms of product performance, the camera image display indicators improved. At present, 2 million and 3 million pixel cameras are the mainstream products in the market, with a total share of 75%. As consumers put forward higher requirements for picture quality, the pixel of the camera has also been upgraded accordingly. The share of 4 megapixel cameras has increased most significantly, from 14% in January to 27% in December.

In terms of product functions, video recording, storage and night vision functions have become the standard configuration of cameras. More than 80% of surveillance cameras have video recording, remote viewing and cloud storage functions. Through cloud and remote, the use of cameras is no longer limited by time and place, more convenient, and also ensures the security of content. 97% of cameras support night vision and gradually evolve to color. The share of day and night full-color cameras increased from 20% in January to 31% in December.

The intelligent analysis function is continuously strengthened, and more and more products support intelligent tracking and detection functions. In 2022, more than 55% of the products support the tracking function, and more than 70% of the products support the detective function.

In addition, the need for family care such as taking care of the old and the young and taking care of pets with surveillance cameras has been released. For office workers and child-bearing families who go out to work, it is just necessary to support the care of the old and young; For pet families, pet care and companionship are also just needed. IT Home learned that in 2022, 9% of surveillance cameras can support crying monitoring, and 8% of surveillance cameras can support pet identification.

Sales share of product attributes in the online market of surveillance cameras in China in 2022, unit:%

Forecast: the scale of consumer surveillance cameras will reach 52.1 million in 2023

RUNTO predicts that the market size of China‘s consumer surveillance cameras will reach 52.1 million in 2023, an increase of 8.5% year on year.

In terms of products, 4 million pixels will become the standard configuration of best-selling products, and 8 million flagship new products will be concentrated on the market; With the support of AI, 5G, Internet of Things and other technologies, video storage, tracking and detective functions will accelerate the penetration; The demand for family care continues to increase, and crying monitoring, elderly fall, pet monitoring, active call and other functions will be more applied to products.

|

Disclaimer: This article is transferred from other platforms and does not represent the views and positions of this site. If there is any infringement or objection, please contact us to delete it. thank you!

中恒科技ChipHomeTek

|