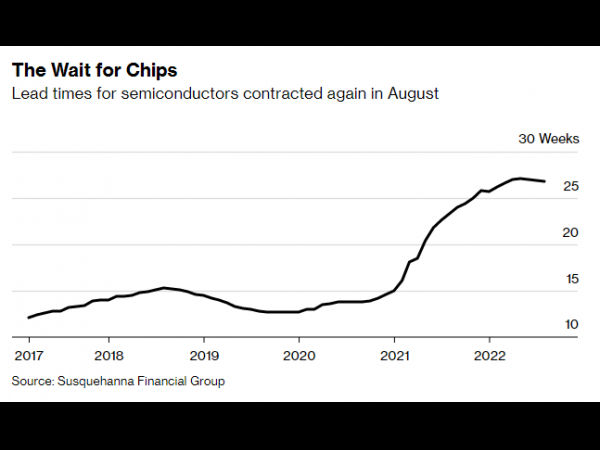

Introduction: the latest news shows that the delivery date of chips in August is further shortened, which means that the global chip shortage is further alleviated, but some types of chips are still in shortage, and manufacturers such as microchip and Infineon still have supply pressure. Looking back on the past, since June this year, the chip delivery cycle has begun to shorten slightly, indicating that the gap between supply and demand in the market has begun to narrow. As of August, the chip delivery cycle has been shortened for the third consecutive month. In any case, if the chip delivery date can be returned to 10 to 14 weeks, it will be in a healthy state.

Today, the latest data from Susquehanna financial group showed that the average chip delivery time in August was 26.8 weeks, one day shorter than last month.

In the past, investors thought that the lengthening of the delivery date of chips represented excessive inventory, and was also a precursor to the sharp decline of the economy. However, after the epidemic led to supply chain disruption and unprecedented shortages, the significance of lengthening the delivery date is different.

Source: SFG

Looking back on the past, due to the serious imbalance between supply and demand in the chip market caused by the COVID-19 epidemic, the chip delivery cycle was once extended to 27.1 weeks in May this year. However, since June this year, the chip delivery cycle has begun to shorten slightly, indicating that the gap between supply and demand in the market has begun to narrow. As of August, the chip delivery cycle has been shortened for the third consecutive month.

Chris Rolland, an analyst at Haina International Group, said that the shortened delivery date reflected the slowdown in the demand for certain technologies, such as mobile phones and PCs, but some markets were still overheated, and orders appeared faster than the supply speed of chip manufacturers. "We believe that over ordering and inventory building have not yet worked."

Coincidentally, Tom sweet, chief financial officer of Dell, also said a few days ago that in the PC market, the supply chain has basically returned to normal operation. With the improvement of availability and the weakening of demand, the cost of many components is becoming cheaper and cheaper. Dell is trying to destock so that it can give full play to its price advantage in the future.

The supply and demand of the chip industry are often difficult to match each other, in part because it takes several months for some components to be produced. In addition, with the increasing demand for chips in economic activities, semiconductor manufacturers now serve a wider range of customers, including automobiles, electrical appliances and industrial equipment.

In other words, there will always be an imbalance between the supply and demand of the chip market, often either an extreme supply shortage or an extreme supply surplus. One of the reasons behind this is that the production of some chip modules takes several months, so it is often difficult for upstream manufacturers to respond to the changes in downstream supply and demand in a timely and effective manner.

Now that the cold winter of consumer electronics demand is coming and the market is going down, once the normal price of some analog chips with high premium returns, the range will be more obvious, and the decline is prone to "diving" and substantial price reduction.

Data show that such phenomena can be found everywhere, especially in models with high heat and large circulation on the market. For example, TI‘s lm358, which once rose to 1 yuan, is now back to 20 cents; Tps51200drcr, once 60-70 yuan, is now 3 yuan. The agent source of ADI interface isolation ICs (such as admx and adumx) has been pushed to the market, and the price has plunged a lot.

ADI‘s market share is second only to Ti‘s. in June this year, its market demand was significantly reduced, the price of general-purpose chips fell greatly, and there were few orders. In the past, it was a rush to buy, but now it is a wait-and-see and price comparison. Downstream terminals hope to get the chips they need at a lower price.

Even so, it is reported that it is "healthy" to return the delivery date to 10 to 14 weeks. At present, some power management components, microcontrollers and optoelectronic components are still in short supply, and orders have put pressure on companies such as microchip and Infineon. However, other chip factories have suffered from falling demand, including NVIDIA and Intel, which are highly dependent on the personal computer market.

It is not difficult to find that with the development of the Internet of things, new energy, artificial intelligence, robots and other emerging application fields, the downstream market of power management chips has ushered in new development opportunities, and the global power management chip market will maintain rapid growth. Data show that the global power management chip market is expected to reach 56.5 billion US dollars in 2026, and the compound growth rate from 2018 to 2026 is 10.73%.

In addition, according to IC insights, MCU sales in 2021 increased by 23% year-on-year, and the global market scale rose to 19.6 billion US dollars. It is expected that the global market will still maintain a year-on-year growth rate of 10% in 2022, and the market size is expected to reach 21.5 billion US dollars.

After all, the process of "three modernizations" of automobiles is accelerating, and the demand for semiconductors of all kinds of automobiles is increasing to varying degrees. Vehicle specification grade MCU is a kind of on-board chip with wide application scenarios, and the market prospect of vehicle specification grade MCU is broad. Based on the optimistic expectations given against the background of the higher than expected penetration rate of new energy vehicles, Founder Securities also predicted that the market size of China‘s vehicle specification grade MCU would reach US $4.593 billion in 2025, with a compound growth rate of 11.22% from 2021 to 2025.

According to the feedback from the secondary market, so far this year, the Philadelphia Semiconductor Index of US stocks has dropped 33%. NVIDIA has dropped 52% and Intel has dropped 38.99%. In contrast, microchip technology and Infineon saw relatively small declines, with 23.78% and 21.66% respectively. Therefore, the "upstart" in the industry seems to be gradually emerging.